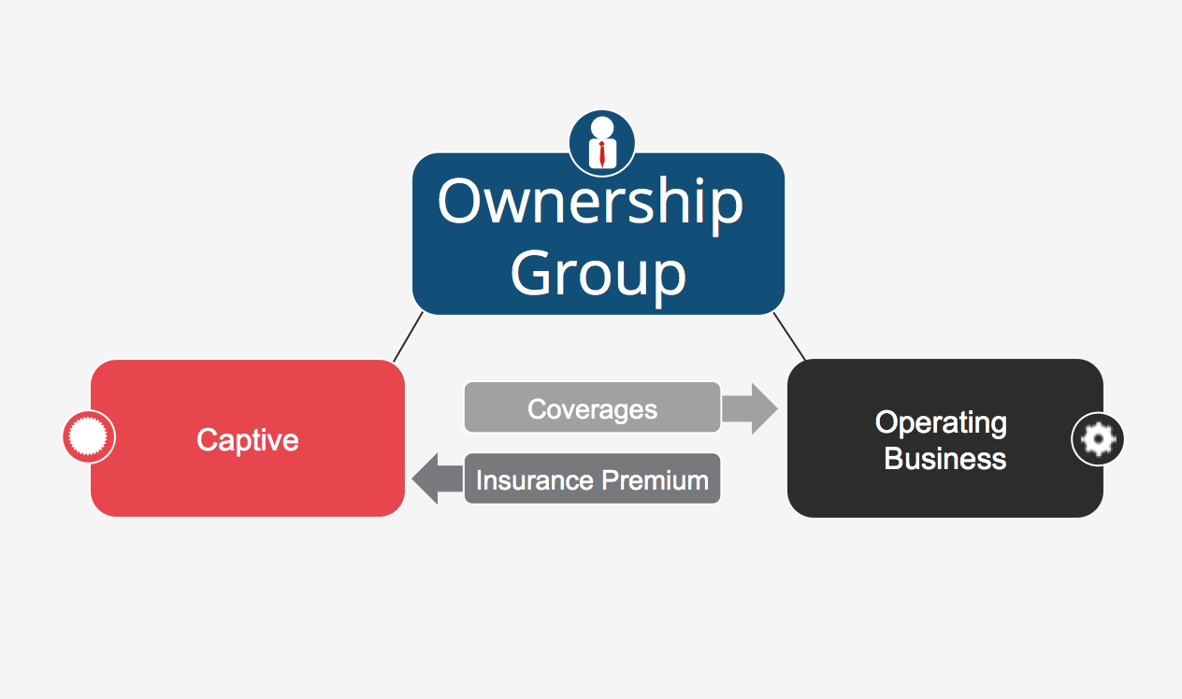

A captive is your own licensed insurance company, created to cover the risks of your business. Instead of paying premiums to a commercial insurer, you build your own coverage — and keep the potential savings.

There’s no one-size-fits-all approach. We help businesses identify the right captive model, including:

Unlike broker-owned managers, we provide objective advice that prioritizes your goals. As an independent captive manager, we work across domiciles and structures, giving you the flexibility to design what works best for your business.

Am I too small for a captive?

Captives aren’t just for Fortune 500 companies. Smaller businesses with sufficient scale can benefit too. Learn more here.

Is an insurance captive complicated to set up?

The process is more straightforward than you may think — and we guide you every step of the way.

Are captives only offshore?

Captives can be formed in a variety of U.S. and international domiciles.

Are captives just for tax savings?

Captives are first and foremost a risk management tool, designed to give you control.

Limits of coverage can be expanded with a captive, or companies can more easily access reinsurance, which creates additional capacity.

The captive can be used to finance risk at a lower cost than with traditional coverage. Many of our clients invest their saved premiums, turning a cost item into a profit center. In fact, our clients often remark how impressed they are with the cost-efficiency and control gained from a captive.

We determine whether forming a captive insurance company for the organization will help improve cash flow and control expenses, so the business is in control of how its premium dollars are spent.

If you're not sure which way to go with captives, follow us. We've been leading the way since 1981.

Contact Paul Macey at pmacey@usarisk.ky to schedule your free consultation call.

/White__cica-logo.png)

/White__Captive-Review.png)

We help companies spend their insurance dollars more wisely so that they are better positioned to achieve their financial goals. We do this by first learning what their company’s financial goals are, as well as current insurance coverage, risk management strategies and claim history. Then we determine whether forming a captive insurance company for the organization will help improve cash flow and control expenses.

[fa icon="phone"] 1-802-371-2281

[fa icon="envelope"] pmacey@usarisk.ky

[fa icon="home"] PO Box 1085, George Town, Grand Cayman, Cayman Islands KY1-1102