At USA Risk Group, we help clients explore the right captive insurance domicile for their needs. Because we’re an independent captive manager, we aren’t tied to one jurisdiction — giving you objective guidance on both U.S. and international options.

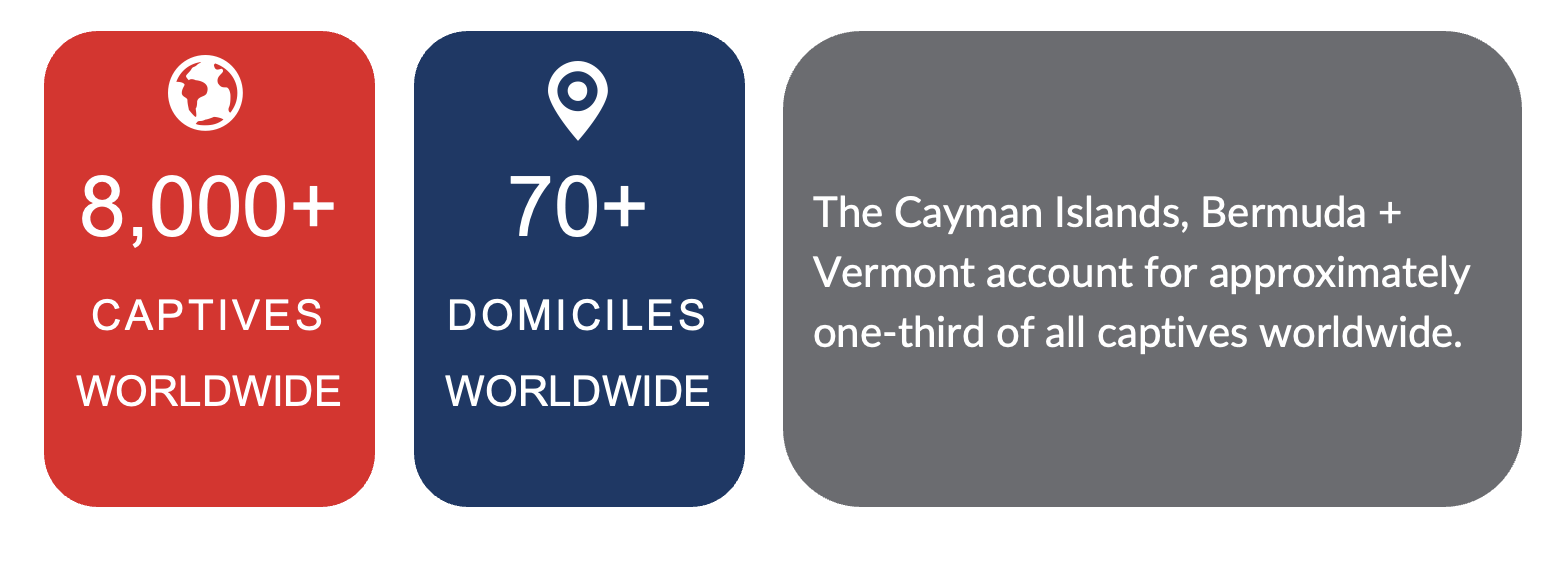

A domicile is the legal home of your captive insurance company — the jurisdiction that licenses and regulates it. Captives can be formed in the U.S. (a.k.a "onshore") or in international jurisdictions (a.k.a "offshore"). The right domicile balances regulation, flexibility, and cost-effectiveness for your business.

Many businesses choose U.S.-based domiciles for their accessibility and transparency. The following are the domiciles we work with in the United States:

| Arizona | Nevada | Ohio | Puerto Rico | Texas |

| Missouri | North Carolina | South Carolina | Tennessee | Washington D.C. |

Others prefer international domiciles for their flexibility and global advantages. The following are the domiciles we work with internationally:

Alberta, Canada

Barbados

British Virgin Islands

Cayman Islands

Because we are independent, we aren’t tied to a specific jurisdiction. We work with you to weigh the pros and cons of each domicile and match your captive to the jurisdiction that best fits your goals. Our role is to simplify the process, so you feel confident in your decision. Here are a few of the most commonly asked questions we hear about domiciles:

A: A captive insurance domicile is the legal jurisdiction where your captive insurance company is licensed and regulated. This could be a U.S. state or an international location, depending on your business goals.

A: The best domicile balances regulatory support, tax structure, setup costs, and long-term flexibility. At USA Risk Group, we guide you through an independent, objective domicile selection process tailored to your needs.

A: Some of the most widely used U.S. domiciles include Arizona, Missouri, Nevada, North Carolina, Ohio, South Carolina, Puerto Rico, Tennessee, Texas, and Washington D.C.

A: We support international captive insurance domiciles, including Alberta (Canada), Barbados, British Virgin Islands (BVI), and the Cayman Islands.

A: Yes. Onshore domiciles refer to U.S.-based jurisdictions, while offshore domiciles are international jurisdictions. Each offers unique benefits in terms of regulation, taxation, and privacy.

A: Yes. Each jurisdiction has its own regulatory requirements, capitalization rules, and oversight structures. That’s why choosing the right domicile is a strategic decision.

A: Independent captive managers like USA Risk Group aren’t tied to any one jurisdiction. That means you receive objective advice and access to a broader range of options.

We help companies spend their insurance dollars more wisely so that they are better positioned to achieve their financial goals. We do this by first learning what their company’s financial goals are, as well as current insurance coverage, risk management strategies and claim history. Then we determine whether forming a captive insurance company for the organization will help improve cash flow and control expenses.

[fa icon="phone"] 1-802-371-2281

[fa icon="envelope"] pmacey@usarisk.ky

[fa icon="home"] PO Box 1085, George Town, Grand Cayman, Cayman Islands KY1-1102