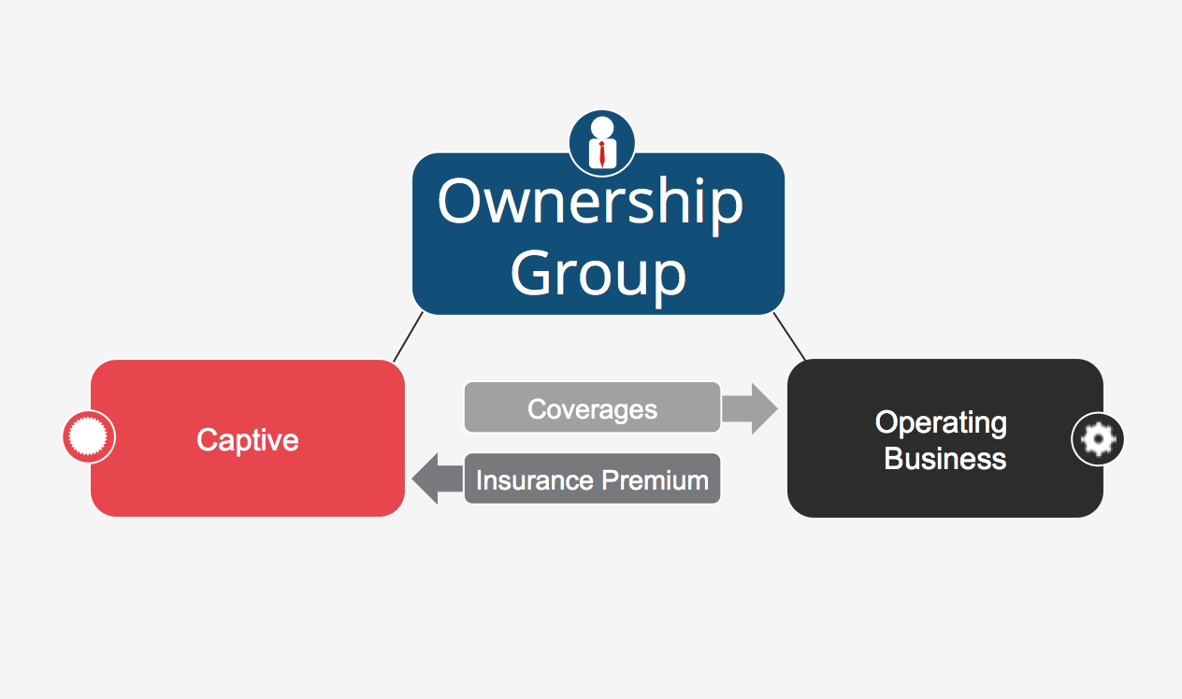

A captive is a licensed insurance company that is wholly owned and controlled by its insureds and insures the risks of its owners.

A captive operates just as any insurance company would by issuing policies, collecting premiums and paying claims. However, it neither offers insurance to the public nor is it regulated like a traditional insurance company. It is regulated as a captive.

Essentially, it allows businesses or groups to self-insure where owners can stabilize coverage for their specific exposures while participating in the potential underwriting profit and investment income.

For the ideal captive candidate, we look for successful, profitable large to mid-market companies in all industries that often have hard-to-place risks or set a strong emphasis on risk management. This includes government entities and non-profit organizations.

Captives can provide insurance coverage for many different lines of insurance. Most cover conventional property and casualty insurance such as general liability, product liability, deductible reimbursement of workers’ compensation, auto liability, professional liability and directors and officers liability.

Risks that are more volatile are typically placed into the commercial insurance market since it has more capital and capacity. However, captives can also provide specialized coverage for these higher risks that are hard to insure such as employee benefits, pollution liability and credit risk to name a few.

Limits of coverage can be expanded with a captive, or companies can more easily access reinsurance, which creates additional capacity.

The captive can be used to finance risk at a lower cost than with traditional coverage. Many of our clients invest their saved premium, turning a cost item into a profit center. In fact, our clients often remark how impressed they are with the cost-efficiency and control gained from a captive.

We determine whether forming a captive insurance company for the organization will help improve cash flow and control expenses so a business is in control of how its premium dollars are spent.

If you're not sure which way to go with captives, follow us. We've been leading the way since 1981. Contact Paul Macey at pmacey@usarisk.ky to schedule your consultation call.

/White__cica-logo.png)

/White__Captive-Review.png)

We help companies spend their insurance dollars more wisely so that they are better positioned to achieve their financial goals. We do this by first learning what their company’s financial goals are, as well as current insurance coverage, risk management strategies and claim history. Then we determine whether forming a captive insurance company for the organization will help improve cash flow and control expenses.

[fa icon="phone"] 1-802-371-2281

[fa icon="envelope"] pmacey@usarisk.ky

[fa icon="home"] PO Box 1085, George Town, Grand Cayman, Cayman Islands KY1-1102